You’ll usually have to pay Council Tax if you’re 18 or over and own or rent a home.

A full Council Tax bill is based on at least 2 adults living in a home. Spouses and partners who live together are jointly responsible for paying the bill.

You’ll get 25% off your bill if you count as an adult for Council Tax and either:

You’ll usually get a 50% discount if no-one living in your home, including you, counts as an adult.

You won’t have to pay any Council Tax if everyone in your home, including you, is a full-time student.

These people are not counted as adults for Council Tax:

To show that you don’t qualify as an adult for Council Tax, you’ll need a declaration from your employer stating that:

You must tell your council. If you don’t, you could get a fine.

The council may ask you to pay back the discount.

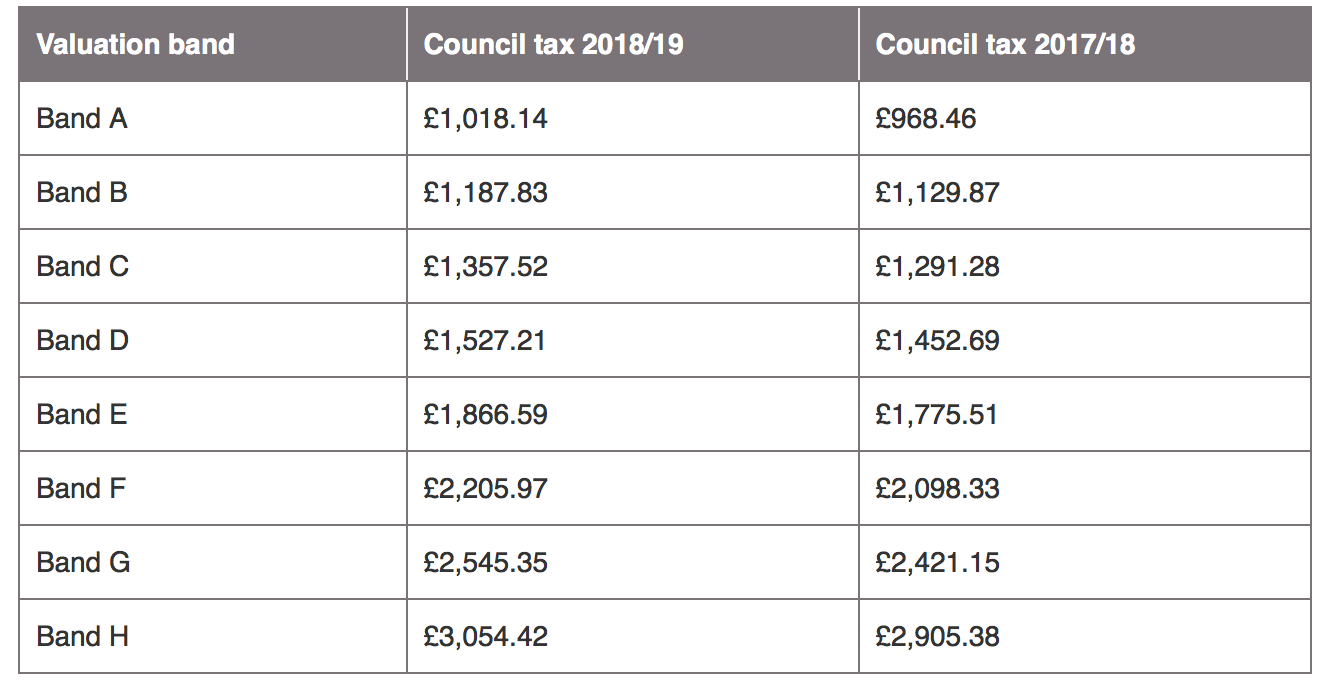

Your Council Tax bill tells you:

You can usually pay your Council Tax online.

You can also use ‘Paypoint’, ‘Payzone’ or ‘Quickcards’ for cash payments at post offices, banks, newsagents and convenience stores.

Check your bill to find out which other payment methods you can use.